The pandemic has altered life for all of us, and finances have not been immune to those changes.

Various surveys have found that many Americans either stopped or lowered their retirement savings contributions due to the COVID-19 crisis. Many others withdrew from their retirement accounts in the past year.

Now that vaccines are available and the economy is rebounding, it’s time to get back on track. A key point to remember throughout this and future crises is that life goes on. Retirement age is coming for all of us, so get prepared. Following are several considerations for your financial health.

create an emergency fund

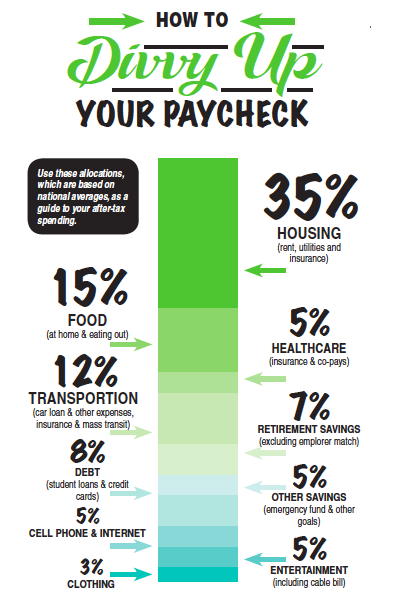

Many financial advisors recommend that you have three to six months of living expenses in a savings account for emergencies.

contribute to an IRA

A traditional or Roth IRA may be an option for those who can’t contribute toward retirement through an employer’s plan, and for those who wish to do something in addition to an employer’s plan. The 2020 contribution deadline was extended to May 17, so there’s time to max out contributions of $6,000 if you’re under age 50, or $7,000 if you’re over age 50.

contribute toward your retirement through your employer

If you stopped or lowered your contributions, or if you’ve never contributed to the retirement plan offered by your employer, it may be time to turn that around. Start small if you must, but start. Consider contributing enough to maximize your employer’s match, if one is offered.

create/review your financial plan

You need a blueprint to build a house and a treatment plan to address a serious health issue, so it stands to reason that you should want a financial plan to ensure you’ve covered all your bases as you work toward retirement. It’s difficult to know if you’re on track to living the kind of lifestyle you desire in retirement if you don’t know whether you’re contributing enough today.

Meet with a financial advisor to create a plan that addresses your goals. This will give you a glimpse into where you are, help you determine where you want to be, and give you an idea of what you should contribute starting today to help you work toward your retirement goals.

Already have a plan in place? Consider reviewing it annually, or when you experience a life event that may alter your financial needs.

Lorrie Delk Walker is a financial advisor with Allen & Company in Lakeland. She is a Florida native who grew up in Ocala and has lived in Lakeland since 1999. She came to Allen & Company in 2019 after spending more than two decades as a journalist and public relations professional.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. No strategy assures success or protects against loss. Investment advisory services offered through Allen & Company of Florida, LLC (Allen & Co) and its affiliate, LPL Financial LLC (LPL), registered investment advisers. Securities offered through LPL, Member FINRA/SIPC.